It would be interesting if we could look into a crystal ball and predict the future of Bitcoin, blockchains, cryptocurrency, decentralized applications and cryptography-based protocols and platforms.

All of this activity is under what I like to call “Crypto-Tech”, as a parallel to Info-Tech which is everything related to information technology.

At the macro level, I think the future of Crypto-Tech will unravel in ways that may not be so different from how the Internet unravelled.

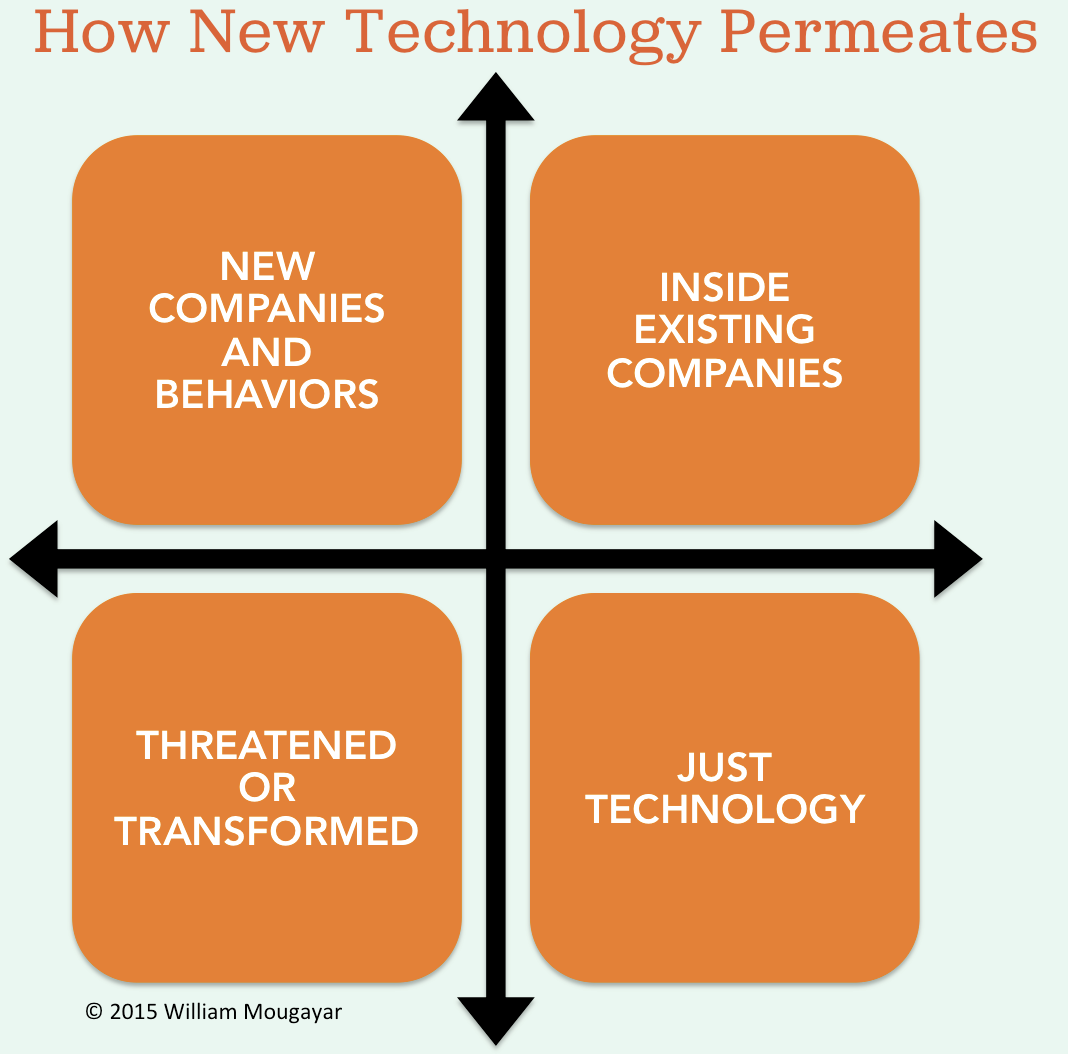

From an endgame point of view; over the past 20 years, the Internet has generated impact along these 4 dimensions:

- New Internet-only companies have emerged.

- Existing organizations (and governments) have adopted the Internet inside their operations.

- Some industries were threatened by the Internet, and it radically changed them or hurt them.

- Web-based software development became a staple for any software application development.

Fast forward 10 years from now, you could replace the word Internet by Crypto-Tech, and the same endgame would hold true:

New Crypto-Tech giants will emerge after being startups. Organizations and governments will adopt new solutions. Industries (and some companies) will be threatened and their business will get affected. And Crypto-Tech development will become part of the software development fabric.

These predictions may feel too high level, macro, meta or generic, but they are helpful as we work backwards, and get ready today for what is bound to inevitably happen, tomorrow.

So how will we get there?

In my opinion, it starts by applying innovations in software development. These innovations will unravel as follows, along the same 4 dimensions of how new technology typically permeates our world:

New Companies and Behaviors

- Online identity and reputation will be decentralized. We will own the data that belongs to us. We will self-manage our online reputations, and as we interact with various people or businesses, only the relevant slices of data will be revealed to them.

- Cryptocurrency-only banks will emerge, offering a variety of financial services based on virtual currencies.

- Decentralized prediction markets will enter the mainstream and offer frequent and credible predictions.

- Distributed Autonomous Organizations will become viable, with self-governed operations and user-generated value creation that tie-back directly to services and financial rewards.

- Spontaneous, and trusted commerce will happen between peers, without central intermediaries, and with little to no friction.

- Content distribution and attributions will be signed on the blockchain in irrefutable ways. Ownership authenticity will be easily verifiable for digital assets and physical products alike.

- Digital or hardware e-wallets will become mainstream, or embedded in smartphones and wearables.

- Seamless microtransactions will be routine, as easily done as giving tips in real life.

- Registry services for assets will exist and become more routinely done online than via visiting physical authorities.

- Users will be able to implement business logic and agreements between them, and easily enforce them on the Internet.

- Services where users earn cryptocurrency by performing routine services will be popular.

- Blockchains will become large repositories of semi-private information; information that is revealed only when 2 or more parties agree to reveal it.

- Global remittances will be routinely performed from smartphones or computers, and as easily done as sending an email.

- Users will use blockchain-based technology without knowing about it; just like using databases.

- There will be 10 widely and commonly used, global virtual currencies that will be considered mainstream, and their total market value will exceed $5 Trillion dollars, and represent 5% of the world's $100 Trillion economy in 2025 (Bitcoin will still be the largest one of them).

Inside Existing Companies

- Healthcare medical records will be instantly and permanently shared between patients and doctors, securely and routinely.

- Legally binding governance related matters will be easily implemented across distributed teams.

- Remote voting will be trusted, even at the country levels in legally binding political elections.

- Trading exchanges (stocks, commodity, financial instruments) will adopt blockchain-based trust services for validating transactions, and streamlining their market-clearing activities.

- Most banks will support routine bi-directional crypto-currency transactions (between fiat and cryptocurrency).

- Most merchants will accept cryptocurrency as a payment choice.

- Accounting, billing and financial packages will include cryptocurrency as standard choices, including crypto-equity.

- Digital goods will be invisibly stamped for their origin authenticity, as a routine. Users will be given visibility into global productions by peering into the transparency of supply chains.

Threatened or Transformed

- Any business that doesn't combine its real-world information into a blockchain (just like the Web mirrors and extends an existing business into the online and mobile worlds).

- Clearing houses with high latency and steep fees.

- Any brokers that don’t offer more than what digital value offers or enables.

- Central lenders that don’t evolve how they lend money.

- Banks that don’t adopt crypto-technologies

- Government services that don’t offer even more remote services, such as for registries, record keeping, licenses, and identifications.

- Notaries that can’t operate virtually with cryptographically secured documents.

- Anyone who is empowered to issue contracts, signatures, escrows, trusts, certifications, arbitration, trademarks, licenses, ownership proofs, wills or other private records.

Just Technology

- Decentralized consensus protocols will become a common part of any technology stack implementations, both in public and private settings.

- Commonly used technologies will include: Distributed Hash Tables and the InterPlanetary File System (IPFS).

- Key-value store databases will be more commonly used.

- Special browsers will enable unique blockchain peering capabilities.

- Smart contract languages will proliferate.

- Writing decentralized applications will become as popular as writing Web apps today (e.g. Ethereum as platform for that)

- Open source protocols will be used and support the creation of new business services and products.

- Running business logic that contains trust and verification components will be plug and play in the virtual sense.

- Peer to peer decentralized base layers will be common in data storage, computing infrastructure, identity, and reputation.

- Decentralized trust will be relegated to the network and embedded inside the applications instead of controlled by intermediaries.

- University degrees in Cryptography and Game Theory will become popular.

- More decentralized forms of cloud computing will emerge.

All of these new scenarios will be based on cryptography-enabled solutions that will make this possible.Having learned the Internet lesson of the dot-com crash, I will end by issuing a warning that “Speed kills”. Speed in hyping what the blockchain can do will kill it, because it puts us ahead of reality, and that disconnect is guaranteed to disappoint those that expect returns faster than what is possible.So, let’s not hype this by assuming it will all happen in the next 10 months. It will happen, but over the next 10 years. There is hard work ahead. It’s a long road, and success will be along the way, not in the initial launching moments.