The more we link our bank accounts to external services and applications, the more we realize that we are living in a world of decentralized banking.

The more we link our bank accounts to external services and applications, the more we realize that we are living in a world of decentralized banking.

The trend has started, and it is more than anecdotal because it’s happening frequently and with greater impact.

Here are some examples:

Linking your Eventbrite event lets you get paid immediately into your bank account.

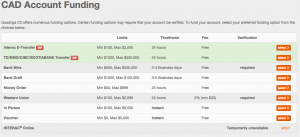

Linking a Bitcoin account lets you move money around the world in less than 10 mins at the cost of pennies in fees, and then you can transfer the money back and forth to your bank account. Actually, here’s an example of a Bitcoin exchange (QuadrigaCX) that provides 9 ways to fund an account via various deposit methods, and 11 ways to withdraw money. Many of these are to/from a bank account, and several of them are free.

And here’s another cryptocurrency exchange (Kraken) where you can perform currency exchange in real-time between 12 different fiat and cryptocurrencies. I can’t do that via my bank unless I have a more advanced foreign exchange account (typically with a large deposit balance), and certainly not offering this wide array of currency choices.

Linking your Kickstarter account lets you get paid for your creative project before you even deliver it, and the money is directly deposited into your bank account.

Linking your PayPal account lets you receive money from a variety of services in real-time (e.g. from Eventbrite), because PayPal acts as a payment processor, and they deposit money in your bank account within 2 days.

Linking ApplePay to a debit card (or credit card) lets you check-out and pay for items in seconds, but the money is really coming from your bank account.

Linking your Venmo account lets you receive money instantly from a friend, then you can push that balance back to your bank account (or vice-versa).

These examples are few but significant, and I know there are others. The point and reality of all these situations is that we, as consumers are doing more interesting things with these new ancillary services than we can, directly from our bank accounts. More importantly, the banks alone would not allow us to accomplish what these linkages enable, which is why we have to go through these intermediaries.

These new services are liberating us from the restrictive features of a traditional bank account.

I can see a not-so-distant future where the bank account becomes more of a back-end service, as we’ll be manipulating money externally via our smartphones, apps, cryptocurrency accounts, or web services directly (e.g. via money pulls following an UBER ride or a Square payment by email, without touching money or cards).

B2B merchants have had a taste of this two-tier separation for a while, via their Point-of-Sale terminals that take money from customers and automatically deposit it in their bank accounts. That was their version of linked services, but now this is more widely expanded to consumers.

Global to Local or Local to Global?

Concurrently, the pendulum is swinging between local and global linkages. Traditionally, banks have had strong local anchors because that's how they were started. Then, they built global linkages between them at great expense and effort, and as an afterthought, via linkages that are proprietary and relatively expensive to maintain.

But with the advent of Bitcoin as a global rails network, other global blockchains and many online services that work from any country to any country, we already have powerful global networks that are seamless across boundaries, and we are now complementing the reach of those new networks by adding local anchors and local users, via your bank account. Suddenly, your traditional bank account will look like no more than a node on the global cloud of financial networks.

In hindsight, geographical regulation which the banks were subservient to (ironically to protect them), became a barrier to the global melding of consumer activity. And by global, I mean across countries and across web services. Operating locally has killed the banks’ abilities to join the more open global web of financial services, except via onramps and offramps, but they aren't anymore the main money highway. And I’ve already discussed this question, Why Isn’t There a Bitcoin Global Bank Today?

A senior banking executive recently told me that, dumbed down, banks provide three basic services: 1) deposit your money, 2) loan you money, 3) facilitate payments.

With the advent of FinTech and Blockchain Technologies, these three areas are now leaky buckets for the banks. Actually, if you get close to a banker, they will tell you that ApplePay and PayPal are very vexing successes to them, because they erode their payment margins. And although regulation has given us benefits relating to consumer protection, knee-jerk regulatory reactions occur and end-up erecting higher barriers for local entry, resulting in pushing users to more global and seamless services because the game is now happening via the web’s interstitials.

This article has covered the consumer and small business side of banking implications. Investment banking, trade finance and capital markets are still wiggling their way with traditional practices, but even in those segments FinTech and BlockchainTech services are coming.

The decentralization of banking is here. It just hasn’t been evenly distributed yet.