In June 2017, the cryptocurrency world got distracted with the flippening prediction, a reference to when Ethereum was going to overtake Bitcoin in terms of market capitalization. That flippening got close, but didn’t happened.

While Ethereum’s chances of closing the gap between its valuation and Bitcoin’s have recently dwindled, there is another significant flippening we are yearning for: the number of token users versus the number of token traders.

Tokens are issued for a specific purpose, typically as the main economic unit of a blockchain protocol, infrastructure, or application. That’s the user view. More user activity in the form of engagement with the platform being provided (infrastructure, protocol or application) is the ultimate goal.

In contrast to the end-user (or developer) view, the investor view is to see the token as a financial instrument whose value appreciates over time.

Currently, there is a divergence of motivation between users and investors. If the bulk of activity is tilted towards investors, that tends to increase the token value, with a risk of over-valuation.

This balance must be achieved on a case by case basis. Each application, protocol or infrastructure must strive to increase its token usage level to counter the natural pressures of investor frenzy that want to push the token price up, without any regard to token-based user engagement. Some investors don’t even understand what the token actually does, let alone have an interest in experiencing its utility. This isn’t unlike the current structure of public capital markets where, for example not all stockholders of Tesla’s stock (TSLA) own a Tesla, but at least they believe in the long term growth of the company, hence buy the stock as a value appreciation proxy.

During my presentations at conferences, my favourite audience question is to ask how many own cryptocurrency versus how many are using the token to actually perform the function it was intended to. While 95-100% typically own cryptocurrency, only 5-10% raise their hands when facing the token usage question.

I’m not sure what the right equilibrium ratio is, or whether knowing it accurately matters. Maybe we can point to Bitcoin and Ethereum as references, since these two networks are mature now with plenty of actual usage. But even then, the volatility in price fluctuations for these two currencies is still high, which points to the fact that speculators still believe that these networks are undervalued, and there is this constant cat-and-mouse chase of value versus valuation.

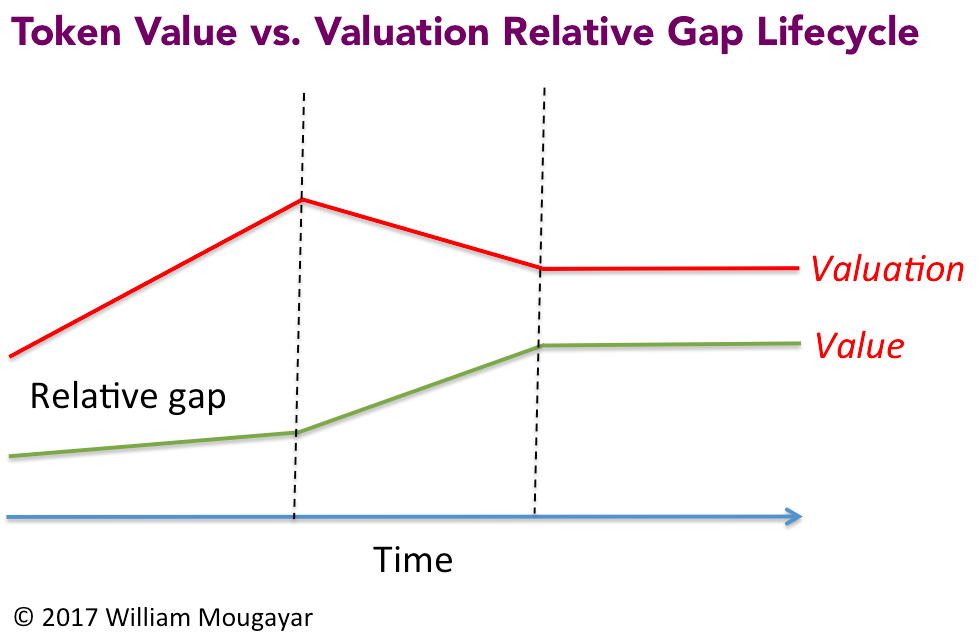

It is generally accepted that the divergence between value and valuation is more prevalent in the early parts of a token’s life. Until there are tangible metrics for quantifying the real value of a token’s utility, the gap between value and valuation will continue to defy conventional wisdom and conventional valuation methods.

The following chart depicts a theoretical progression for the value vs. valuation gap, over the lifecycle of a token. Note that the depicted gap is relative.

I’ve already written about this in this past article, where I’m re-publishing a relevant passage that is worth re-reading:

In traditional venture investing, we are used to relatively well defined stages: angel, seed, Series A, B, C, D, E, F, then IPO. Each one of these phases has generally accepted stage characteristics pertaining to product evolution (alpha, beta, launch), product-to-market fit, and continued user growth, and resulting market acceptance and share.

In public companies, analysts and investors use metrics such as revenues, net income, EBITDA (earnings before interest, taxes, depreciation and amortization), EPS (earnings per share), P/E ratio (price to earnings ratio), and sales growth in order to correlate market capitalization justifications.

For ICOs and token-based projects, what are the equivalent performance metrics?

In the long term, there is no escaping real metrics, and these are only visible after the market launch stage. Perhaps they will be similar to traditional financial performance metrics, and maybe there will be new ones that emerge.

Ultimately, how do we achieve valuation rationality? What will replace the price to earnings ratio, a key driver to market capitalization values?

Some argue that a decentralized protocol doesn’t need a direct revenue model, because an open protocol is free to use. It is typically driven by an open source community and/or a foundation. However, even non-profit foundations need an operational budget which could come either from donations, or from a percentage of token ownership. Foundations and ICO projects can theoretically continue selling some of their tokens in order to finance their operations indefinitely, as long as the markets continue to give them healthy valuations, based on the strength of their ecosystem, volume of transactions, or real revenues.

However, it is still unsure whether continuously dipping into the publicly crowdsourced markets to finance operations is a long term viable approach.

Not all ICOs are created equal, and not all of them are protocols who can live on the strength of an ecosystem around them, let alone the token that gave them birth. Although all projects have visions of being the next Bitcoin or Ethereum (just as regular startups dream of being the next Google or Facebook), we are seeing many ICOs looking just like applications, marketplace products, or technology solutions. They will need to eventually show real revenues or viable business models in order to strengthen and support the public valuations they will be receiving.

I believe we will eventually return to more palpable metrics to guide us in measuring the valuation characteristics for marketplace, product, and applications-based ICOs because they will have revenue expectations. Protocols are a bit different, and they are still a new beast whose success characteristics may still be unclear. To make things more interesting, not all decentralized applications need a special protocol, and not all protocols necessarily need a special token. Keep in mind that some decentralized applications rely on an underlying protocol that only serves the application itself, which means that the protocol’s market importance could be over-stated.

I’m looking forward to seeing more ICO projects provide increased clarity about the performance metrics expectations they plan to exhibit during their future adult lives, in addition to the assumptive utility of that token they are selling.

This is why I’m a proponent of seeing some visible form of operational token utility prior to allowing the token to trade in the hands of public speculators. Even if the token utility is still not mature or complete, at least seeing its beginnings would give a reality check on where it is going. (Melonport is a very good example of a protocol that can already be used with its token, prior to its final public release)

The speculative hype can live for so long before there is real value. A vision, a white paper, or market advocacy are not tangible value. They are a promise for future value.