Cutting to the chase, here’s what I’m seeing in blockchain and crypto markets. I started writing these thoughts last week, before signs of the current market downturns became visible.

Meme Coins Will Not Yield Anything Except Speculative Fever

I understand the power of community sentiment and excitement as levers that can lift demand, but the intent of a cryptocurrency is not just about the cliché statement: “number goes up”. A bonafide cryptocurrency must serve a purpose and have multiple utilitarian use cases. Meme coins are an interesting phenomenon, but they offer little utility outside of speculative trading. Cryptocurrency markets are already irrational to start with. If you add uncertainty on top of uncertainty, you get irrationality at a multiplied level. The meme coins mania will not end well. Cryptocurrency is not a game or a joke.

SEC and Regulators Still Too Slow

There are the two types of regulators: the slow ones, and the negative ones. As the leading body amongst Western regulators, the SEC continues to be slow and overwhelmed in terms of bringing significant change. A ray of hope was recently uttered by SEC Chairman Gensler when he hinted that a new regulatory entity might be needed in order to properly deal with crypto-regulation. In my opinion, a focused (new) U.S. regulatory body will be necessary if we want to see real innovation in the form of benign regulation. Otherwise, we will get a continuation of hit-and-miss positions, incomplete guidance, overlapping regulatory frameworks, more wild-west behavior and overall risk for all involved. No new regulation is as bad as some incomplete regulation.

China Needs To Blockxit

Let’s be straight: China does what is good for China. Corollary: China doesn’t care about the impact of its actions on the rest of the world. True for technology, economy, trade, healthcare, politics and cryptocurrency. When the Chinese government says they are banning cryptocurrency, miners, crypto-banks, ICOs, or whatever the next thing is, these directives are oriented towards its own people. However, these communications missives muddy the water because of global interdependence implications. For example, I’m looking forward to the day when Chinese miners aren’t the majority anymore. Like the boy who cried wolf too many times, China’s roars on cryptocurrency are often like thunderstorms that don’t bring rain, or a bark without the bite. Each time China tries to whack the next mole, the crypto industry goes “ouch”, feels some pain, but things quickly rebound thereafter, by discounting these actions, and the whole market gets stronger overall.

Exchanges Crave Volumes, Not Validation of Projects

Most exchanges are challenged about managing their vertiginous growth. Volumes are their drug, and they need increasing fee revenues to continue funding their operations. In addition, they are fighting like hell to differentiate themselves from what appears to be a commoditized business. However, exchanges are not the ultimate quality validators for projects, despite what they might lead you to believe. At the end of the day, they just want volumes and will list token projects that are making headlines. Just look no further to how quickly many of the top exchanges tripped over each other to list the top meme coins, caving-in to “popular” demand.

No Price Discrimination

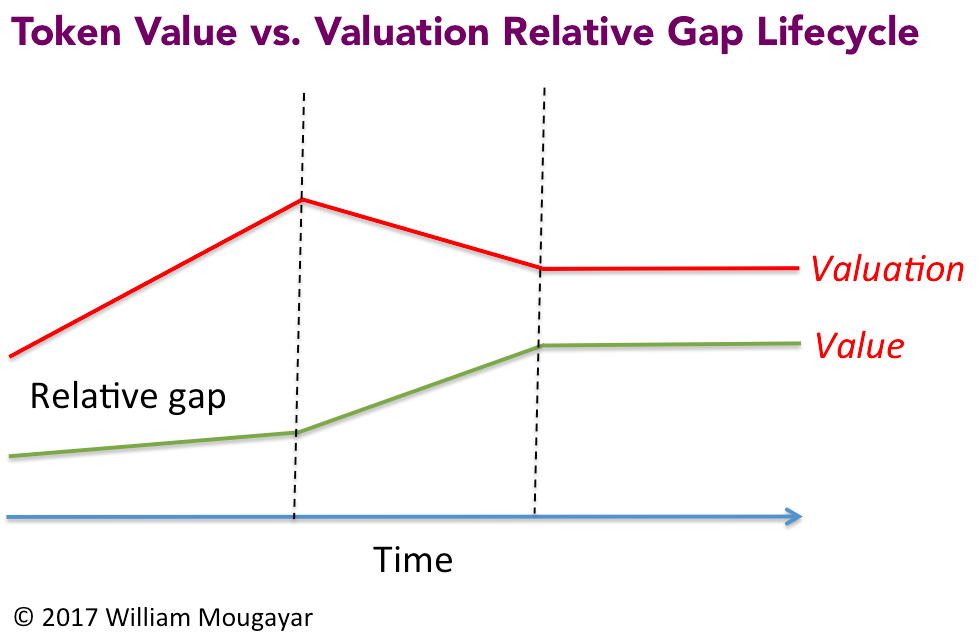

The reality is: some projects are under-valued, while many others are over-valued. But here’s the key question: how do you rationally evaluate tokens? Transaction levels, number of users and fee volumes (if applicable) are still the true North of activity; assuming there is a real raison d’être for a token. Many token-based projects have “apparent” success if you judge by their market caps, a number that has become a vanity metric more than anything more indicative of real value. Many crypto market caps need to be discounted, as there is little correlation to their fundamental metrics.

Governance Tokens Are Overrated

At the heart of most governance tokens, you will see a common legal rider that “the token has no economic value...holders have no claim on financial rights...governance token is used to oversee the xyz ecosystem”. That said, the dichotomy is that, no sooner are these tokens declared to be governance tokens, and supposedly distributed to “voters”, that you see that same token being listed on exchanges (central or decentralized), and very quickly these “no economic value tokens” start to earn exponential economic benefits to their holders. Incidentally, many of these “governance-first” projects end-up with very low voting turnouts (1-3% is not uncommon), and most of them don’t even have a utility role that is critical to operations.

Bitcoin and Ethereum Still The Only True Leaders

I’m not only referring to market cap leadership, although these 2 coins command close to 64% of the overall crypto market cap (as of June 22 2021). Rather, the fact that there are only 2 true leaders in a new emerging era is problematic when you contrast to the 5 Web2 leaders that comprise the FAANG analogy. Today, Facebook, Apple, Amazon, Netflix and Google have a combined market value of $6.7 Trillion, and if you add Microsoft, those 6 tech leaders add-up to $8.7 Trillion. Bitcoin is sitting at about $600B market cap and Ethereum close to $220B. What will be the FAANG of crypto? We are probably far from seeing that group emerge, although for fun, I have made-up the CUBBE gang: Coinbase, Uniswap, Binance, Bitcoin, Ethereum, as potential blockchain lighthouse leaders.

DeFi Is Underhyped, And Mostly Mysterious

Despite its kwarkiness and risk, DeFi is the tip of the iceberg when you think of the future of global finance. But DeFi’s impact won’t be so significant unless it reaches awareness and adoption levels that are orders of magnitudes over the current ones. For that to happen, the barriers to user adoption must be lowered even further. Democratizing liquidity provisioning might be a foundational core upon which other layers build on top of. But each successive layer must be solid first, so that the whole doesn’t come crashing when things start to shake or when the boundaries get tested.

Talking Heads Who Are Not Experts

The market is fickle with commentaries from talking heads who don’t see anything but price action and momentum plays. Every other TV financial commentator is now asked to talk about Bitcoin or cryptocurrency when their knowledge is actually superficial or opportunistic. Most of them are clueless and just spitballing stuff. The loudest or most articulate mouth isn’t the smartest nor the most insightful. Beware of so-called experts who aren’t really experts. Ask them to enumerate several cryptocurrency use cases, or to intelligently describe DeFi, and their knowledge will be as thin as a razor. Someone who invested in an NFT company or just bought an expensive NFT last month is not necessarily an expert on NFTs or their future.

Ethereum Killers Who Are Not

“Ethereum killers” will not kill Ethereum, but will make the market larger. So-called Ethereum killers are still gunning for it, touting this or that feature as their ace card. However, those claims aren’t going far, because each blockchain should stand on its own, by self-differentiating itself based on its peculiar features or achievements. The reality is that - as other emerging blockchains become successful, they make the market larger as a whole. Ethereum and Bitcoin are in a league of their own. Most other blockchains attempt to mimic Bitcoin/Ethereum key aspects, with some degree of variation. Claiming feature superiority is one thing, but acquiring a network effect level of users to validate market success is an entirely different ball of wax.

Working Together Doesn’t Exist

The blockchain is natively global. It knows no borders, and doesn’t like barriers. Just as global issues require global cooperation to solve our world problems, I wished there was more native cooperation between some blockchain standards to increase interoperability, and make the user experience more seamless. Take stablecoins for example. When sending them around, you often need to specify which blockchain network you want them settled on. Sometimes, it’s a choice of 6 different networks. The user shouldn’t need to worry about that. On the other hand, wrapping coins on Ethereum has proved to be another way to ingest standards instead of fighting them.

Wallets Are Still Archaic

On one extreme, there are innovative wallets that are optimized for DeFi (e.g Zapper or Zerion), and on the other side of the spectrum, there is a variety of straightforward wallets that are simply optimized for token swaps. Of course, there is MetaMask as the uber wallet for non-custodial transactions. But there isn’t an all-around wallet that combines ease of use, security, variety (e.g. voting/rights access), DeFi, NFTs and generalized Dapps entry. General-purpose wallets will be to blockchain what browsers were to the Web. We need to see an evolution of wallets that captures the imagination of millions of users. Just as browsers stitched together the hyper-connectivity of content, wallets are stitching together the hyper-connectivity of money.

ICOs By Another Name

ICOs are still happening, but they aren’t called ICOs in order to stay under US regulatory radars. They typically start via a private offering of tokens at a favorable price to accredited investors. Then, a small percentage of tokens is offered (typically to non-US investors) at attractive prices with a cap on the allowed amount (in the $500-$1,000 range) in order to fake the decentralization of ownership, which is a factor along the decentralization spectrum. All these have some lock-up periods that are not excessive. Then, the network is launched, and the token is gradually released into circulation, and finds itself trading on DEXes first, then it gets picked-up by exchanges, depending on the number of headlines generated.

I do not see how the industry can positively move forward while logging garbage tokens with it. Some large market cap tokens in the top 20 will be a train wreck when it is revealed that the Emperor had no clothes. Some other under-valued tokens that represent real token usage, transactions, a circular economy, and active users will emerge and earn their rightful place along the valuation spectrum.

Irrational exuberance and bubbles are good propellers of activity. But bubbles don’t discriminate between good and bad activity.

No matter where we are in the overall market cap spectrum, we need to ask again this fundamental question that Vitalik Buterin once asked in December 2017 when the crypto market hit its first half Trillion mark: “Have we earned it”? Now, this question needs to be applied to each and every token and organization behind it, not just to the market as a whole.