There is some irony and nonsense, pertaining to the SEC and how they continue to view cryptocurrency.

Suppose you develop a blockchain-based App (or dApp), and use BTC or ETH as your in-app currency for something like buying/selling, earning/spending, etc. You are not subject to SEC regulation, because BTC and ETH were already deemed as non-securities, and you appear to be just like any other tech startup developing software. You are only using cryptocurrency as a choice for the monetary exchange of value, instead of the dollar, yen, euro or pound.

So far, so good.

What if, one day after you’ve proven your traction and model, you decide to switch to your own cryptocurrency, and you then allow users to swap their crypto balances and/or NFT holdings from their wallets to your new cryptocurrency? What happens then?

You still haven’t sold an ownership in your company, nor have you promised an expectation of profits. Would your token then be deemed a security, a "decentralized enough" utility, or an acceptable payment cryptocurrency? Would you be subject to SEC regulation and be required to submit follow-on filings, if any?

What if you retained a percentage of the tokens you originally issued to your users, and subsequently, these cryptocurrency tokens appreciate in value, because, due to your success, a secondary market has developed around your "hot" cryptocurrency? Would the SEC then consider your token as a security, although you’ve already widely proven its utility and your original intent had an expectation of usage before any expectations of benefits?

Is this all confusing? Yes, because the SEC prefers to fit everything inside their existing Securities compliance thinking. Yet, tokens exhibit salient novelty factors that didn’t exist before: 1/ they have multiple usage properties, 2/ their lifecycle is dynamic, and 3/ they can be traded in new secondary markets,- all of these are new elements that don't fit the old mold.

Software Products Are Not Broadway Plays

For the sake of arguments, let’s follow SEC Chairman Clayton’s theatre play analogy [starts at 15:00]. In this November 2018 interview, Chairman Clayton says “if your play is done”, the tickets sold are not securities anymore, because “all you can exchange the tickets for is watching the play”, even if the tickets sold prior to the play’s opening were deemed securities. So, using that train of logic, if you’ve already developed the software, and you are now providing a means to exchange currency (crypto or not) for a variety of transactions within your marketplace or service, then that token shouldn’t be a security.

Unfortunately, the SEC has not being prescriptive enough in admitting that several tokens with proven functionality are not securities anymore. The theatre play analogy alone is not strong enough, as software products (unlike theatre plays) are never “fully developed” because software continuously evolve. New features and capabilities are introduced, enabling users to perform new actions they couldn’t perform before. So, how can a regulatory agency judge when a given software product is complete enough in order to grant it a sufficiently operational status?

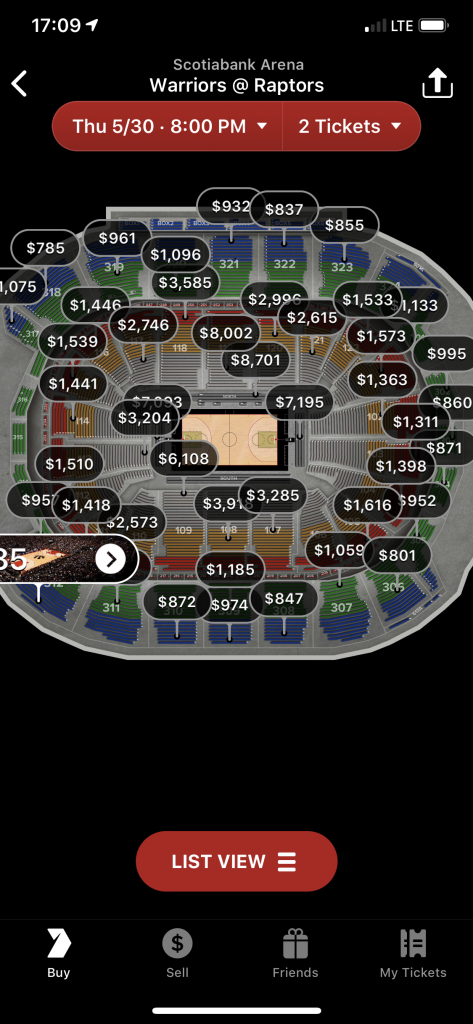

Let’s consider this other comparison: the secondary market for events tickets. Here’s a heatmap of ticket prices for the first game of the 2019 NBA championship. A good number of tickets are available at exorbitant prices fetching 10-50 times the original ticket costs. These prices are inflated due to speculation and “hotness” factors surrounding the event, given that it is the NBA finals, and the fact that the Raptors kept winning beyond foreseen expectations. Original ticket owners will profit from their re-sales, even if they didn’t have an expectation of profits when they bought their tickets, and even if they had intended to watch all games, and not sell their seats later.

Here is the irony of this second analogy: if these ticket prices were quoted in cryptocurrency and/or issued by a project that distributed crypto-tokens, the SEC would likely be labelling them as securities.

Then, if you followed the SEC’s logic, they would regulate StubHub, VividSeats, Ticketmaster, Live Nation, Gametime, Viagogo, etc. And anyone buying these tickets would be subject to KYC/AML screenings. You might think that these amounts are small enough to fly under the scrutiny radars, and the analogy may be far fetched as it pertains to cryptocurrency and ICOs. That’s not entirely correct, because the average consumer contribution to an ICO has been in the $3,500 range, and several ICOs have average contributions as low as $1,000. Furthermore, several token services are offering micro-transaction levels of activity, in the value range of cents or fractions of dollars, yet the SEC wants to regulate these activities and exercise undue supervision on them.

If It Doesn’t Fit, Create a Glove that Fits, Don’t Force-Fit It

Contrary to what the SEC believes, every token issued is not a security. Each token has a different functionality lifecycle and exhibits a variety of properties.

If only the SEC would see the innovation potential behind tokens and cryptocurrency, they could adapt their existing regulation to allow token models to prosper, instead of forcing all companies to fit an old model that doesn’t apply anymore.

Instead, today’s reality is filled with confusion, irony, contradictions, uncertainty and fear.

As a result, companies are fleeing the US and Canada and planting their innovation seeds elsewhere. Therefore, the future tech giants of the cryptocurrency era will not based in North America. The few that remain in North America are jumping through costly hoops and battling an uncertain future that will be even more costly to the industry as a whole.

I wished the SEC would clarify their stance more precisely pertaining to the sequence of events and circumstances surrounding the evolution of token functionality. It is obvious they have not been clear enough, judging by their latest Framework for "Investment Contract" Analysis of Digital Assets, and and here was my analysis.

[In a recent Twitter survey I posted, 81% of respondents felt that the SEC has NOT been clear enough enough in defining what constitutes a “Utility Token” that would be exempt from the same compliance requirements that follow existing security laws.]

It is time for the tech industry and all of its advocacy associations and centers to rally together and find the common voice that unites it.

As an external observer, a prominent European securities lawyer told me recently they were astonished that no one in the US seems to be strongly challenging the SEC about their limited optics on the state of tokens.

If the SEC was seriously interested in the well-being of the crypto industry in the US, they would open-up a new registration process for ICOs and token offerings, and ask a few questions, such as the ones I enumerated almost two years ago, in my post Safe ICO Practices.

Subjecting the token novelty to an old regime is not the answer. Most companies cannot afford the costs and uncertainties of a Reg A+ process (estimated at $1.5M-2M), and it only solves the issuance stage, not the trading, nor the usage of tokens by real users.

So, as an industry, what do we do? Do we let the SEC continue to mislead us, confuse us, divide us, scare us, and string us along? Or do we rally with a common voice that enlightens the market more than obscucates it? Alas, this is the juncture we are in.

This is why we need to DefendCrypto.

Defend Crypto is a new initiative that the Kin Foundation has started to galvanize the industry and fight the good fight with the SEC. You can help by donating to this defense fund. This matters a lot, because the stakes of winning these arguments are high. Winning will pave the way for other bona fire token projects that want to succeed and innovate in North America.

As the Defend Crypto website aptly notes, we need to let the SEC know that we won’t be pushed around anymore. It is time to Defend Crypto.

You can join me in supporting DefendCrypto by contributing to it, and by voicing your support for it.