Let’s beg the question - how relevant are traditional Wall Street fund managers as investors in the crypto sector?

My viewpoint is that we need fund managers that are long term believers and are committed because they have done their own original research. They should be able to understand crypto to the point where they are able to comprehend what the technology does, where it is going, and are able to form their own defendable (and original) thesis across the many emerging blockchain sectors. But do they?

For example, of the traditional investors that get it, Ray Dalio is one of them. In a CNBC interview this morning, he said that he sees Bitcoin, cryptocurrencies or digital gold, as part of the “new money” that is a medium of exchange and a store-hold of wealth that you could move between countries. He admitted that Bitcoin had made tremendous achievements over the past 11 years towards those goals.

Sadly, many other so-called crypto investors have a superficial knowledge pertaining to what they got into, and often haven't even used the technology themselves.

Fickle investors will flee their investments the minute there is a weakness or bad news, because they need to protect their capital, and will wait for the next momentum cycle.

Maybe, the crypto industry was too early for the proverbial "Here comes everybody".

Most current crypto investors have no real relationships with the projects they are investing in, except the relationship they have with the price chart. I doubt some of them even spoke to entrepreneurs directly.

Investing in crypto is not yet like investing in the stock market where companies are at a known stage of predictability in their business, and where valuation metrics are more easily quantifiable or visible. There is no such thing as a missed quarter that later corrects itself. Instead, the field is full of information asymmetry.

Traditional Money Managers Don’t Get It, Won’t Get It, Can’t Get it

Reality is that not all traditional fund managers will be able to fully comprehend, let alone believe in the crypto revolution. The grand-daddies of conservatism, Buffett and Munger have already spoken, and their views are the epitome of denial that there is something new here.

In part, the analogy of asking traditional fund managers to get into crypto is like asking a professional basketball player who has never heard of soccer to suddenly play that game. Imagine they would start saying things like:

The net is too wide, that doesn’t make sense!

You can’t touch the ball with your hands? That will never work.

Why is the field so long and wide? It will be too tiring to go up and down both ends!

Why are there 11 players? You can’t easily talk to each other.

Why don’t you stop the clock if there is a whistle? That’s not fair.

Well, the rules of soccer are very different from those of basketball. And the type of players it attracts is different. Both games have tackling, intercepting, shooting, and blocking in common, but it doesn’t mean that an athletic basketball player that is willing to learn and adapt couldn’t play soccer if they wanted to. However, not all of them will be able to.

Taking the analogy one step further, imagine a sports regulator stepping in and saying: we’ve had the rules of basketball for years, all other sports must adapt to them.

What Matters is Who is Staying, Not Who is Leaving

During the UST/Terra debacle and overall crypto prices correction of mid-May, talking-head after talking-head went on CNBC exposing their ignorance of crypto and predicting the darkest scenarios about an industry they clearly never understood well enough. Most of them would be hard pressed to talk for more than 15 secs about what crypto really does in terms of the variety of use cases and state of practice.

In retrospect, it wouldn't be such a bad thing if some types of investors flee the crypto markets, as they get replaced by smarter ones who get the longer term view. What matters is who is staying. Developers, entrepreneurs, smart investors and dedicated users are all staying.

If the narrative shifts too hard towards prices, speculation and superficial involvements, instead of latching on the fundamentals of blockchain technology via a discriminating eye, we have lost the plot about what crypto is about.

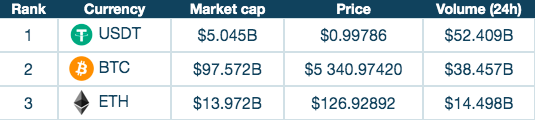

It is mind boggling to see most coins (especially the L1 variety) move up and down almost at the same rate. Do these “investors” clearly have any clue about how different the top 10 L1 blockchains really are? For example, for the amount of weight it carries and share of transactions it commands, it is surprising that Ethereum's market dominance keeps hovering below the 20% level.

As long as most cryptocurrencies fall and rise in unison, and investors follow each other like sheep, this points to the fact that the market is full of investors that are not very sophisticated nor discriminating. The crypto industry will not be able to break free of its own if it continues to be linked to the vagaries of the traditional markets.

In the next post, I will debunk the theory of crypto-to-market coupling…or decoupling.