Friday the 13th of March 2020 will be remembered as the morning-after.

The morning-after North America came to grips with the fact that the Coronavirus is among us.

The morning-after US and Canadian stock markets tanked like they haven’t before, in decades.

The morning-after global crypto-markets reached lows that set it back to December 2018.

The COVID-19/coronavirus situation has already done its damage, not just to human lives, but to the financial markets, and consequently it has affected people’s wallets, investments, and many businesses that will suffer, at least in the short term.

As if it wanted to punctuate the point, we now know that the Coronavirus has also hit a known Hollywood actor, a top NBA player, the wife of the Canadian prime minister, and the president of Brazil. That’s a good dose of celebrities at once for the mainstream headlines, pushing awareness, fear or knowledge to another level.

I don’t watch the crypto markets on a minute by minute basis, but I did so intermittently yesterday to better understand what was going on. Around 10pm EST, when I saw Ethereum dip into the 90’s and Bitcoin cross below the $4,000 mark, I said to myself - this is now overdone.

Sure enough, shortly after 10pm, the crypto markets started to bounce back, in part due to short interest covering, and in part due to the traders’ realization that this was overdone.

That said, I expected the crypto markets to do better than the (traditional) markets, and I can’t understand why that didn’t happen. Cryptocurrency should have offered a flight to safety for those who were liquidating their stock equity positions and getting into bonds. Perhaps that was wishful thinking on my part. Others, such as Brian Armstrong, CEO of Coinbase were also surprised.

Either investors didn’t have enough confidence in cryptocurrency as a safe haven, or they didn’t have easy linkages to efficiently enact capital transfers from brokerage accounts into crypto-trading ones. Or maybe it was a bit of both.

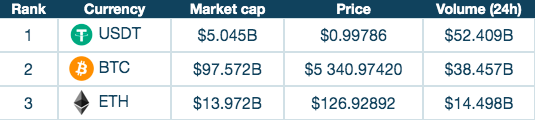

Regardless of the real reasons (and there may be several of them), it is noteworthy that during this mayhem, stablecoin USDT’ trading volumes were higher than Bitcoin’s at $52B+ over the past 24 hours. That’s close to 35% of the total market crypto market cap (as of March 13th 2020). That doesn’t necessarily mean that $52B in stablecoin holdings are sitting in people’s accounts, but it could be a factor when demand starts to flow back into cryptocurrencies.

The US economy is getting a $1.5 Trillion stimulus package. What is the crypto-economy getting? Nothing. So, it will need to pick itself up on its own, and grow again.

This is a challenge that the industry can tackle, and I believe it can do so if we continue executing on the following ideas:

- Continue working on the best projects that highlight variety and innovation in the application of the blockchain, not just work on the technology itself.

- Communicate in clear, precise and non-obscure language the benefits of specific implementations.

- Don’t stop knocking down the barriers with regulators who are erecting them and being tough gatekeepers.

- Continue funding the best projects, companies and ideas that promise to make the crypto market (as in usage) larger and relevant to the average consumer.

The good news is that the fundamentals of blockchain technology have not changed, and they have not been altered. The recent downturn in market prices is just another stress test on the sector. It can only emerge stronger and better than before, because it has been there before. Extreme volatility is part of the history of cryptocurrencies.

This is not a time to lose confidence, nor lose hope over the blockchain promise. The sector will emerge stronger and more resilient, I am sure about it.